Post Disclaimer: This blog reflects the author's personal experience with end-of-life matters and is provided in good faith for informational purposes only. While we aim to provide clear guidance on hard-to-find topics, this content is not legal advice and your use is at your own risk. Estate planning and end-of-life laws vary by location, so please consult your state's laws and seek guidance from a licensed attorney for your specific situation. We make no warranty about the accuracy or completeness of this information, which does not replace professional legal counsel. For more information, please see our full disclaimer.

An estate EIN, or Employer Identification Number, plays a crucial role in estate management.

It's essential for handling tax-related duties after someone passes away.

This number identifies the estate in its financial transactions and is needed to manage the estate's ongoing responsibilities.

Understanding what an Estate EIN is and when you need it can simplify the process during a difficult time.

It helps in opening estate accounts, filing taxes, and ensures compliance with legal requirements.

By streamlining these processes, an Estate EIN minimizes stress and confusion, allowing you to focus on what truly matters – honoring your loved one's legacy.

Understanding Estate EINs

In the tangled web of estate administration, an Estate EIN—or Employer Identification Number—serves as a crucial thread.

This unique number helps you identify and manage an estate separate from your personal finances.

Whether opening a bank account for the estate or filing necessary tax documents, the Estate EIN plays a pivotal role.

Definition of an Estate EIN

An Estate EIN is a unique, nine-digit number assigned by the IRS to estates, enabling them to handle financial transactions independently of the deceased’s personal Social Security Number.

This number marks the estate as a distinct legal entity, simplifying many of the financial intricacies that arise when managing a deceased person’s affairs.

It's essential for anyone involved in estate administration, as this number is used to track the estate’s income, debts, and tax obligations.

Difference Between Estate EIN and Social Security Number

While both an Estate EIN and a Social Security Number serve as identifiers, they operate in fundamentally different arenas.

A Social Security Number (SSN) is tied to an individual's lifetime earnings and benefits, whereas an Estate EIN exclusively identifies an estate.

The EIN begins to serve its purpose only after death, underscoring its unique application.

Unlike a personal SSN, an EIN maintains the legal requirements essential for letters of testamentary, which grant executors authority to manage the estate effectively.

Understanding these differences ensures a smoother transition during challenging times, and emphasizes the necessity of an Estate EIN in distinguishing the estate from personal assets, thereby preventing any potential legal or financial confusion.

Why You Need an Estate EIN

Throughout the often overwhelming process of settling a loved one’s affairs, having an Estate EIN is like having a master key for the estate's financial essentials.

This number isn't just a bureaucratic requirement; it's an essential tool that simplifies the complex processes of estate management.

Below we explore why securing an Estate EIN is a vital step, to ensure seamless handling of obligations and assets.

Tax Obligations of an Estate

Every estate must wrangle with tax responsibilities, and this is where the Estate EIN becomes crucial.

When a person passes away, their estate remains liable for income and possible estate taxes.

An Estate EIN allows you to file the necessary tax returns on behalf of the estate, ensuring compliance with all tax regulations.

Imagine trying to file taxes without the right identifier; it's akin to trying to mail a letter without an address.

The Estate EIN helps track income the estate earns, like interest or dividends, separating these financial dealings from your personal taxes.

Understanding your new tax obligations doesn't have to be daunting, especially with resources like this guide on death certificates that can help with initial steps in managing an estate.

Managing Estate Assets

Managing an estate means juggling numerous assets, ranging from bank accounts to other financial holdings.

One of the first steps here is opening a new bank account under the estate's name, and you'll need an Estate EIN to do it.

This number authenticates the estate’s bank transactions and ensures clear lines between personal and estate funds.

Picture the Estate EIN as a passport that allows the estate to engage in financial activities independently.

It also ensures that, during asset management, transparency is maintained and financial records remain intact and orderly.

More insights into the steps immediately after a loved one passes can be found in resources like the Death of a Family Member Checklist.

Distributing the Estate

Eventually, the assets need to be transferred to heirs, and this process can be fraught with legal hurdles.

An Estate EIN streamlines this phase by functioning as a unique identifier in this legal journey, ensuring that each transaction is properly documented and traced.

Think of sharing a pie among friends, with each piece needing precise cutting without overlap or loss.

The Estate EIN helps accurately track these distributions to avoid any mix-ups during the allocation of assets, making what can often be a scramble of paperwork a more structured and transparent process.

Learning how to craft a will can streamline these final steps, as seen in tools for making a will that guide estate planning effectively.

By obtaining and utilizing an Estate EIN, you uphold precision and legality, safeguarding both the estate's integrity and the intended wishes of your loved one.

Each aspect from taxes to asset management, and eventual distribution, becomes a more manageable part of the estate’s path forward.

How to Obtain an Estate EIN

Managing an estate during a difficult time comes with numerous responsibilities, including the crucial task of obtaining an Estate EIN.

This number is vital for handling the myriad of financial duties that follow a loved one's passing.

It's your facilitator in fulfilling tax obligations and managing estate finances effectively.

Eligibility Requirements

Before diving into the application process, it’s critical to understand the eligibility requirements necessary to apply for an Estate EIN.

Essentially, the estate must exist solely for settling the deceased’s obligations.

Typically, an executor, administrator, or personal representative manages the estate and applies for the Estate EIN on its behalf.

Requirements include:

- Designation as Executor or Administrator: The applicant must hold legal authority granted by the court to manage the deceased's estate. If you've obtained letters of testamentary, you fulfill this prerequisite.

- Valid Identification of the Deceased: A key requirement is the deceased’s Social Security Number (SSN) or previous EIN, establishing identity and tax details.

- Proof of Death: This often involves providing a certified copy of the death certificate, a critical document for estate management; details on obtaining this are found in this guide on how to get a death certificate.

Application Process Steps

Once you’ve confirmed eligibility, you can begin the application process for the Estate EIN.

Completing these steps accurately ensures a smooth progression in handling estate affairs:

- Gather Required Documentation: Ensure you have the legal documents proving your authority, deceased’s information, and the estate’s details.

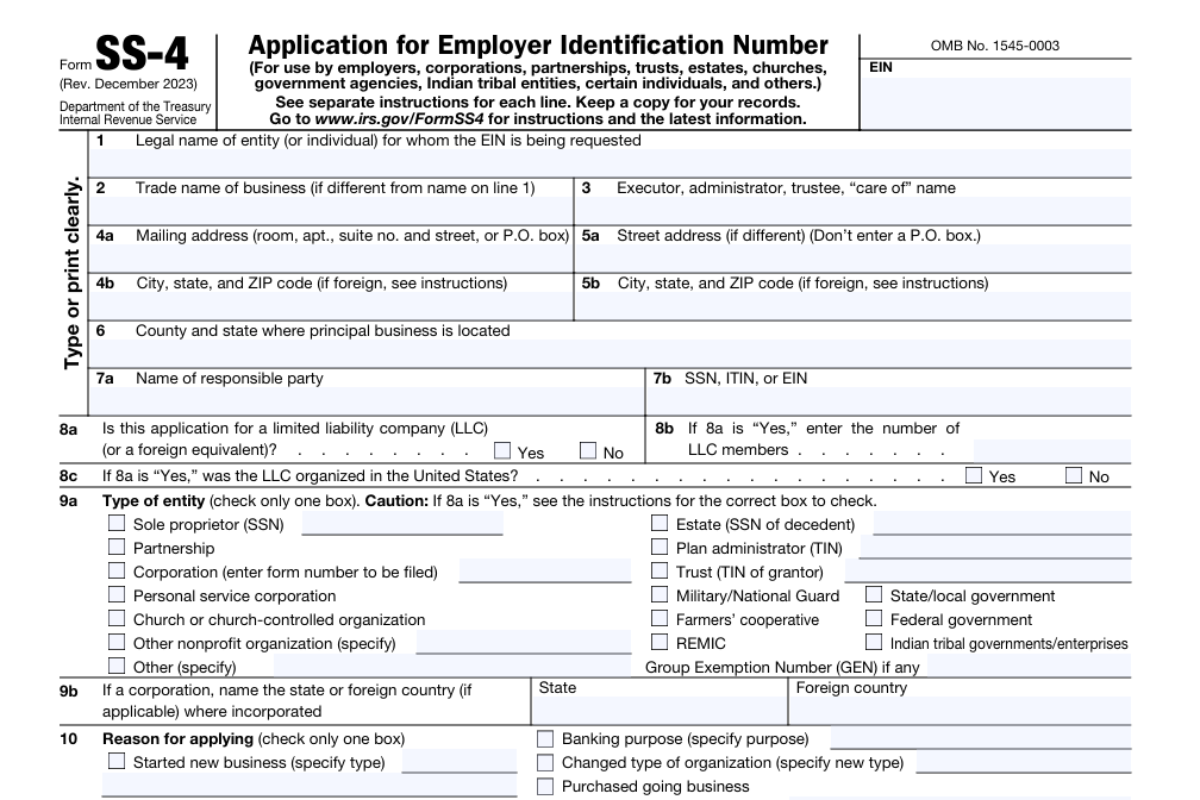

- Complete IRS Form SS-4: This form is central to applying for an EIN. While it might seem overwhelming, treating it as a detailed checklist can simplify the task. Fill out the form with the estate’s information rather than any personal details.

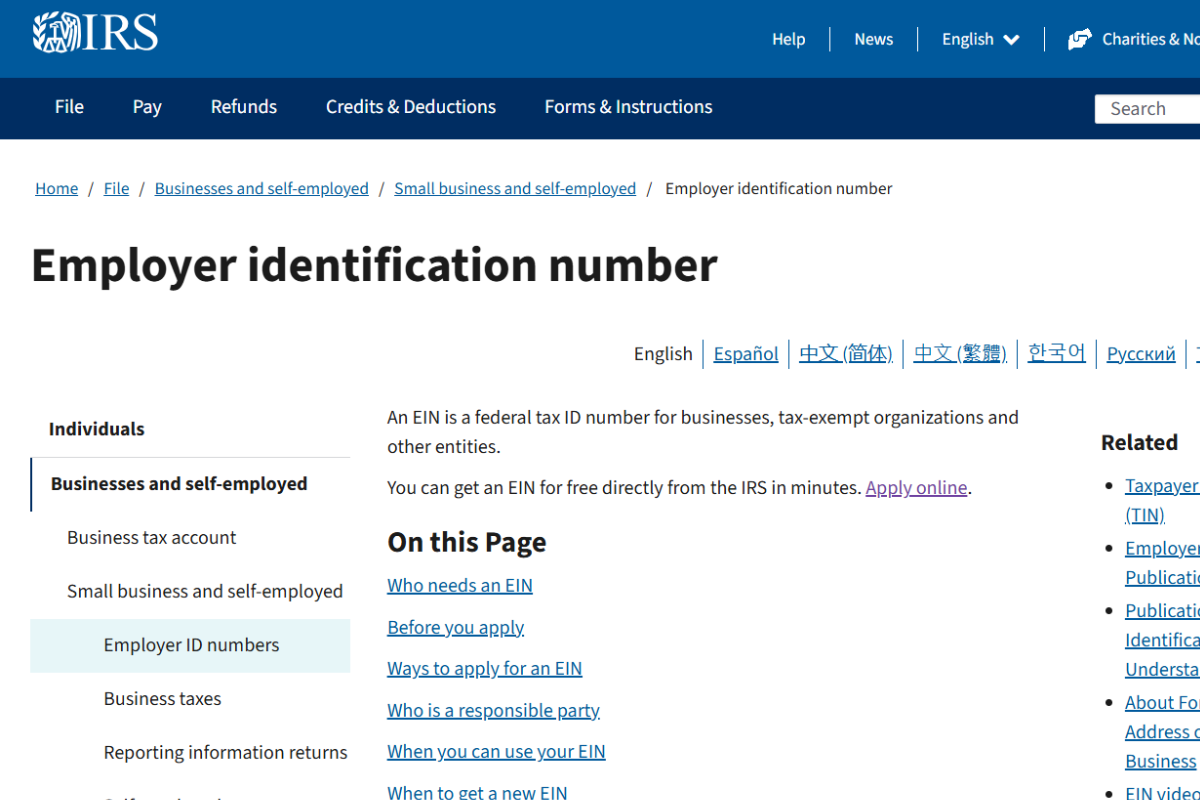

- Choose Your Application Method: You can apply online, by mail, or via fax. The online method is the most efficient, offering immediate processing and quick delivery of your EIN.

- Submit the Application: Based on your chosen method, submit the necessary forms and await confirmation. The online application via the IRS website is immediate, providing you with the Estate EIN promptly.

Remember, applying for an Estate EIN doesn’t have to be daunting.

By understanding the requirements and following the correct process, you facilitate the legal and financial responsibilities inherent in managing an estate.

For additional resources on estate administration, explore our executors' legal responsibilities guide to navigate this challenging role effectively.

Common Estate EIN Mistakes to Avoid

Navigating the management of a deceased loved one's estate is challenging enough without the added burden of avoidable errors.

Ensuring that you don't fall into common traps can make the process smoother and honor your loved one's wishes.

Below, we explore key missteps you should aim to sidestep.

Failing to Obtain an EIN

One of the fundamental missteps in estate management is neglecting to secure an Estate EIN.

This number is vital for distinguishing the estate's financial activities from personal finances.

Without it, the estate cannot perform basic tasks like opening a bank account or filing necessary tax documents.

Trying to manage an estate without this identifier is like setting off on a journey without a map — you’re bound to run into obstacles.

Tax complications can quickly snowball, and the estate may find itself in trouble for not complying with legal obligations.

Avoid this by ensuring you obtain an Estate EIN as a priority, laying a strong groundwork for handling all subsequent estate affairs.

Incorrect Application

Filling out forms can feel tedious, yet accuracy is crucial. A frequent error is submitting incorrect information on the EIN application.

A small mistake in names, Social Security Numbers, or estate details can lead to significant delays.

The IRS uses this application to verify an estate's legitimacy; any discrepancies can pause the progress, compounding stress during an already difficult time.

It's akin to inputting an address incorrectly into a GPS and ending up lost. Double-check every detail before submission to ensure the process is seamless.

For those needing guidance in these first steps, resources that combine practical and emotional support, like Managing Grief While Fulfilling Estate Responsibilities, can be invaluable.

Properly navigating estate management involves careful attention and due diligence.

By understanding and avoiding these common mistakes, you're better equipped to fulfill your duties effectively and honorably.

Wrap-up: Estate EINs

Acknowledging the critical role of an Estate EIN in estate administration can provide much-needed clarity in a time filled with emotional and logistical challenges.

It is instrumental in maintaining financial precision and ensuring that legal obligations are met effectively.

The EIN becomes a pillar of support, helping to create clear boundaries between personal and estate dealings, thus fostering peace of mind during estate management.

An Estate EIN facilitates seamless tax compliance and financial management, setting a solid foundation for carrying out estate duties.

Understanding Executor Responsibilities can further strengthen your grasp on handling an estate’s affairs, providing detailed guidance for those appointed as executors.

Having these tools at your disposal allows you to focus on preserving the legacy of your loved one.

If you need a structured roadmap, resources like the Death Notification Checklist offer comprehensive insights.

By equipping yourself with this knowledge, confronting the complexities of estate management becomes a path of honoring those we've lost, rather than just a task list to complete.

Check out the Up & Doing glossary page for an alphabetical listing of key terms related to estate administration, funeral planning, and other end-of-life topics.